30% Super Tax on Balances Exceeding $3 Million from 2025

As of 1st July 2025, earnings from super balances exceeding $3 million will increase to 30%.

The Australian government has announced a reasonable compromise to tackle the cost of tax concessions on large superannuation balances. Treasurer Jim Chalmers revealed that starting from July 1, 2025, earnings from super balances exceeding $3 million will have a higher tax rate of 30%, while the existing rate of 15% will continue for earnings on super balances below $3 million that are in the accumulation phase. Chalmers added that this change is modest and only affects 0.5% of Australians with balances above $3 million. The remaining 99.5% of Australians with superannuation accounts will continue to enjoy the same generous tax breaks that apply today.

Treasurer Chalmers had two major choices to make before finalising the new policy, which is expected to generate around $2 billion annually. The first option was to introduce a new superannuation tax bracket at $3 million, which is what the government eventually chose. The second option was to impose a cap of $3 million on the amount that could be held in the superannuation structure, with the excess removed. Chalmers had initially preferred the second option to avoid increasing taxes, but it was deemed inferior due to the complexities that would arise, such as forced sales of illiquid assets, capital gains tax implications, and resetting cost bases for assets that were sold or transferred.

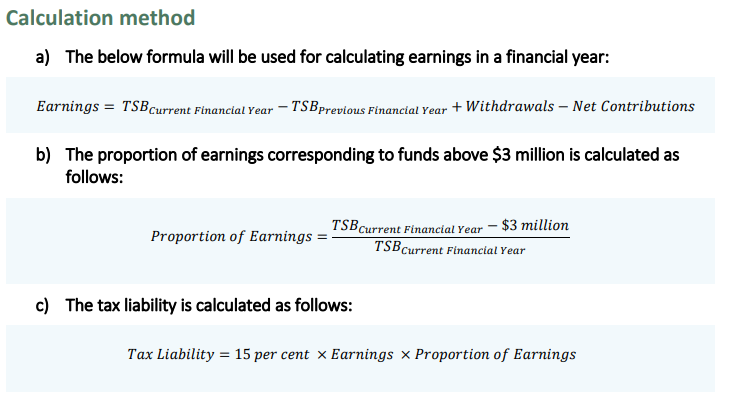

Under the new policy, individuals will have a Total Superannuation Balance (TSB), and those with a TSB exceeding $3 million by the end of a financial year will be subject to an additional 15% tax on their earnings corresponding to balances above $3 million. This means that earnings attributable to balances above $3 million will generally attract a combined headline rate of 30 per cent.

Notably, the new tax limit is applicable per person and not per fund, such as a Self-Managed Superannuation Fund (SMSF). Furthermore, a separate Notice of Assessment will be issued to the Individual for the additional new tax and will function similarly to the existing Division 293 tax Notices.

Individuals subject to the new tax will be given the option to pay it out-of-pocket or from their superannuation funds. In cases where an individual has multiple superannuation funds, they can choose the specific fund from which the tax will be paid.

If the Fund derives any negative earnings in any one year, then the portion of the negative earnings that relate to that part of the Members superannuation balance that exceeds $3 million can be carried forward and offset against taxable excess earnings in future years.

Source: ATO

Example of a Balance exceeding $3 million

For more information about this targeted Superannuation concession, read the Fact sheet available from the ATO:

https://atotaxrates.info/wp-content/uploads/2023/03/better-targeted-superannuation-concessions-factsheet.pdf

Published: