Superannuation Payment Deadlines & WorkCover Key Dates

Factor1 and SDP are so humbled and honoured to be named finalists in the 2023 Australian Accounting Awards.

Factor1 and SDP are so humbled and honoured to be named finalists in the 2023 Australian Accounting Awards.

Factor1 and Factor1 Shepparton are so humbled and honoured to be named finalists in the 2023 Australian Accounting Awards.

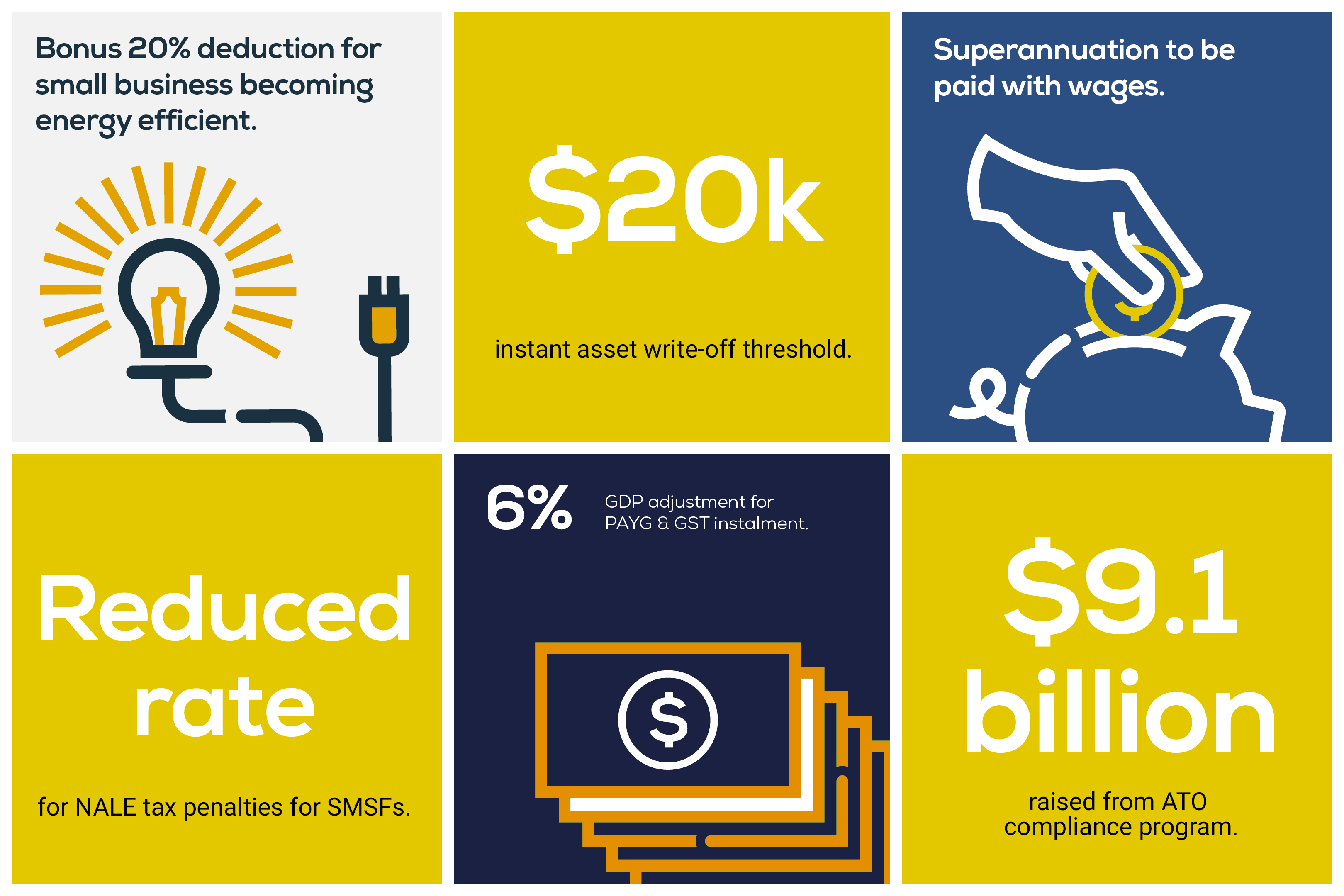

Key points to take away from the Federal Budget for 2023-24. Here are some important things about taxes and retirement savings from the Budget that can help people and businesses plan their finances.

If your taxable income is below $126,000, please be aware that the Low and Middle-Income Tax Offset (LMITO) has ended on 30 June 2022, which will impact your tax returns for the 2022-23 financial year. This means that without the offset, your tax bill will be higher this year, resulting in either a higher tax liability or a lower tax refund during tax time.

Two available grants: the Victorian Primary Producer Flood Recovery Grant and the Victorian Rural Landholder Grant.

As of 1st July 2025, earnings from super balances exceeding $3 million will increase to 30%.

Single Touch Payroll (STP) Phase 2 is an expansion of the ATO’s payroll reporting system, where you’ll be required to report additional information and clarify the payments you make to your employees. Move to STP Phase 2 before the 1st January 2023 deadline.

For those of you who have employees, here are the Superannuation payment due dates for the current financial year.

For those of you who have employees, here’s a friendly reminder of the key dates to submit your certified rateable remuneration to your WorkSafe agent.

For those of you who have employees, here’s a friendly reminder of the key dates to submit your certified rateable remuneration to your WorkSafe agent.

New grant for employing small businesses to access professional advice.

Register your .au domain name by 20 Sep to avoid losing it to a competitor!

Contact Email: [email protected]

Contact Email: [email protected]

Contact Email: [email protected]

Contact Email: [email protected]

Contact Email: [email protected]

Contact Email: [email protected]

Contact Email: [email protected]

Contact Email: [email protected]

Contact Email: [email protected]

Highly qualified in all areas of business development and operations from asset acquisition and start-up operations to financial management and marketing. David also helps clients with financing, insurance, superannuation and financial planning.

Contact Email: [email protected]