Federal Budget 2020-21 Summary

5 minutes read on Australia’s Economic Recovery Plan

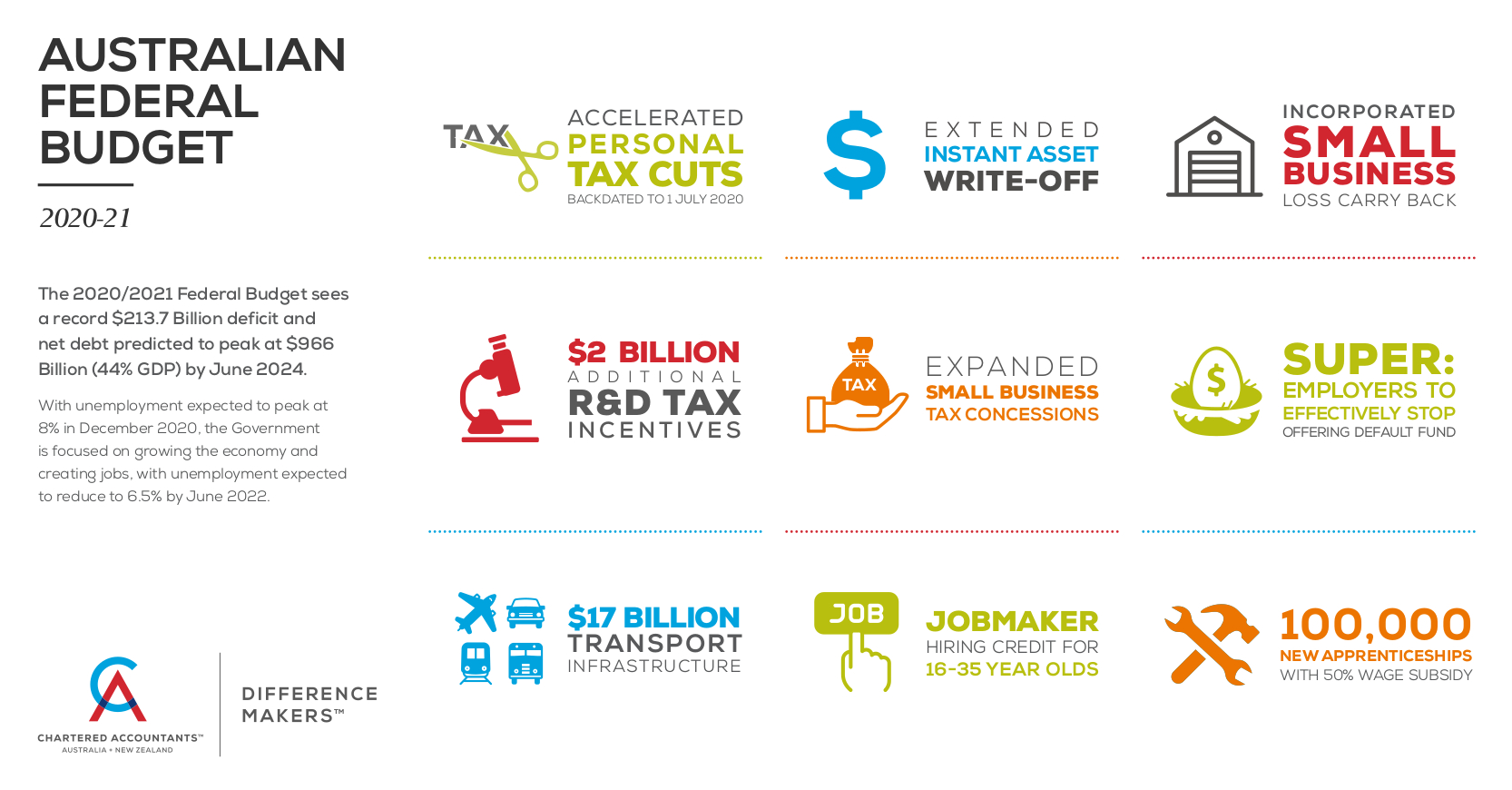

(Click on the Infographic above to download the file)

On 6 October the Treasurer delivered the Federal Budget, which will see big government spending on infrastructure, job creation, asset write-offs and personal tax cuts in the coming year as part of Australia’s economic recovery plan from the unprecedented impacts of COVID-19.

SUMMARY

- A record $213.7 Billion deficit and net debt predicted to peak at $966 Billion (44% GDP) by June 2024.

- Unemployment is expected to peak at 8% in December 2020, keeping the Government focused on creating jobs. It expects unemployment to fall to 6.5% by June 2022. However, there is no indication of how the Government plans to fund this expenditure and ultimately repair the Budget. That will happen when unemployment falls below 6%.

1. Accelerated Personal tax cuts

An additional $17.8 billion announced in personal income tax relief to support the economic recovery, including an additional $12.5 billion over the next 12 months. More than 11 million taxpayers will get a tax cut backdated to 1 July this year as the Government brings forward “Stage 2” tax cuts to 1 July 2020. In 2020-21, low- and middle-income earners will receive tax relief of up to $2,745 for singles, and up to $5,490 for dual-income families, compared with 2017-18 settings. Treasury expects most of the benefit will go to those on incomes below $90,000.

2. Extended instant asset write-off

The instant asset write-off is being made even more generous and temporarily extended. From 7:30pm (AEDT) on 6 October 2020 until 30 June 2022, businesses with turnover up to $5 billion will be able to deduct the full cost of eligible depreciable assets of any value in the year they are installed. The cost of improvements to existing eligible depreciable assets made during this period can also be fully deducted.

3. Small business loss carry back

Companies with turnover up to $5 billion will be allowed to offset losses against previous profits on which tax has been paid, to generate a refund. Eligible companies can carry back tax losses from the 2019-20, 2020-21 or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years. Companies may elect to receive a tax refund when they lodge their 2020-21 and 2021-22 tax returns.

4. Additional R&D incentives

An additional $2 billion is being invested through the Research and Development Tax Incentive. For small claimants (turnover less than $20 million), the refundable R&D tax offset will increase and there will be no cap on annual cash refunds. For larger claimants, the intensity test will be streamlined and the non-refundable R&D tax offset will be increased. The cap on eligible R&D expenditure will be lifted from $100 million to $150 million per annum. These changes apply from 1 July 2021 and are expected to support more than 11,400 companies that claim the incentive.

5. Expanded small business tax concessions

Amendments will allow businesses with less than $50 million aggregated annual turnover (up from $10 million) to access up to 10 small business tax concessions.

6. Super reforms

Under the Government’s latest reforms to super, employers will effectively stop offering a default fund and superannuation funds will be required to meet an annual performance test under guidance from APRA. The Government will also establish an online comparison tool known as ‘YourSuper’.

7. Transport Infrastructure spend

Infrastructure investment announced in the Budget now totals $14 billion in new and accelerated projects over the next four years. The projects are expected to support 40,000 jobs during their construction. There is also an additional $3 billion for small scale road safety and the Local Roads and Community Infrastructure Program supporting a further 10,000 jobs. Funding will be provided to state and local governments on a ‘use it or lose it’ basis.

8. JobMaker hiring credit

The $4 billion JobMaker Hiring Credit will be payable for up to 12 months for each new job and is available from 7 October 2020 to employers who hire eligible employees aged 16-35. The Hiring Credit will be paid quarterly in arrears at the rate of $200 per week for those aged between 16-29, and $100 per week for those aged between 30-35. Eligible employees are required to work a minimum of 20 hours per week. To be eligible, employers will need to demonstrate an increase in overall employee headcount and payroll for each additional new position created. Treasury estimates that this will support around 450,000 jobs for young people.

9. New apprenticeships and trainees

Businesses that take on a new apprentice or trainee will be eligible for a 50% wage subsidy starting 5 October 2020. But the subsidy is capped at 100,000 workers. The $1.2billion subsidy will be available to employers of any size or industry.

10. Insolvency reforms

Forming part of the cutting red tape initiatives are recently announced reforms to the insolvency framework in more than 30 years. The changes, which will start on 1 January 2021, would enable more Australian small businesses to quickly restructure.

——–

Source: https://www.charteredaccountantsanz.com/news-and-analysis/news/2020-21-australia-budget

Date Posted: 7 October 2020