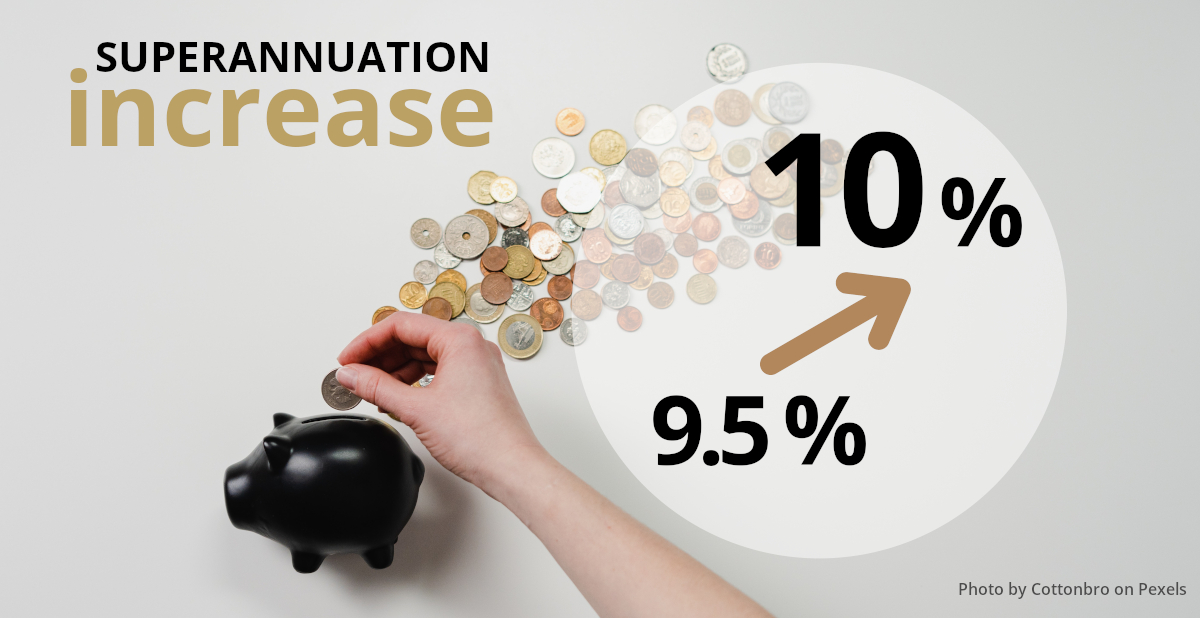

Super Guarantee Rate Increased from 9.5% to 10%

From 1st July, 2021

On 1 July 2021, the super guarantee rate increased from 9.5% to 10%. The rate is scheduled to progressively increase to 12% by July 2025. Here is ATO’s table of scheduled rate increases.

Super guarantee percentage

| Period | General Super Guarantee (%) |

|---|---|

| 1 July 2020 – 30 June 2021 | 9.5 |

| 1 July 2021 – 30 June 2022 | 10.0 |

| 1 July 2022 – 30 June 2023 | 10.5 |

| 1 July 2023 – 30 June 2024 | 11.0 |

| 1 July 2024 – 30 June 2025 | 11.5 |

| 1 July 2025 – 30 June 2026 onwards | 12.0 |

If you need help to work out how much super you need to pay for your employees after the rate increases, you can use ATO’s super guarantee contributions calculator. For salary and wage payments made on or after 1 July 2021, the minimum superannuation guarantee contribution rate of 10% will need to be applied.

If you have employees, you will need to ensure your payroll and accounting systems are updated to incorporate this rise.

Date posted: